The chart below summarizes the primary sources of payment for OT services in the United States.

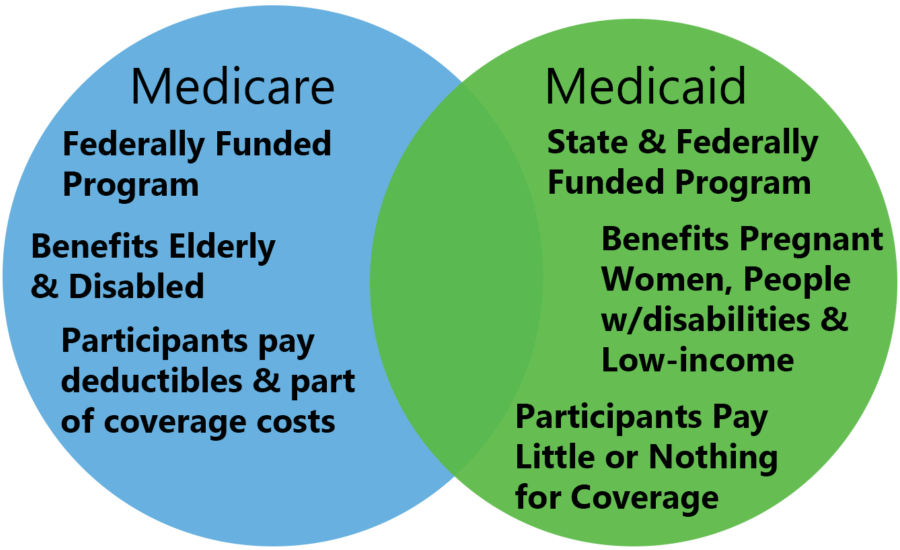

These sources include Medicare, Medicaid, and private insurance.

| Insurance type | Who is covered | What is covered | Occupational therapy coverage | Out of pocket costs |

| Medicare Part A | -People age 65 and older -People under age 65 with black lung disease and permanent kidney failure -People under age 65 with other long term disabilities -People under age 65 who have received Social Security benefits for at least 24 months |

-Inpatient hospital stays for acute health conditions if hospitalization is required for 2 consecutive midnights (3 days). -Services in skilled nursing facilities if the patient has an acute condition, has had a qualifying hospital stay, and requires 5 or more days per week of skilled nursing care or rehabilitation. -Hospice care -Home health care for intermittent nursing care and/or physical, speech, or continued occupational therapy |

–Covered for inpatient hospital stays and skilled nursing facilities if determined to be medically necessary by a patient’s physician -Covered for home health care if medically necessary and the patient is home bound. Occupational therapy is covered as a single service if continued service is medically necessary. |

No premium for people who receive Social Security benefits. Deductibles and coinsurance apply, depending on the length of stay and qualifying period. |

| Medicare Part B | Same as Medicare Part A. To receive Medicare Part B, people must enroll and pay a monthly premium. | -Outpatient services that are medically necessary. -Preventative care services |

-Unlimited services in a hospital outpatient clinic. -Unlimited services as a part of a comprehensive home health care plan. -Unlimited services in all other settings. Services must be certified as medically necessary by a physician. If Medicare denies coverage because it finds that it is not medically necessary, the patient has the right to appeal |

80% of approved charges.

Medicare law no longer limits how much it pays for medically necessary outpatient therapy services in one calendar year. Previously, there were limits, known as the therapy cap. However, in 2019, the therapy cap was removed. |

| Medicare Advantage Plans | Same as Medicare Part A & B. People purchase Medicare coverage through a private insurance agency. | -Same coverage as Medicare Parts A & B. -Additional services may be covered for additional fees. |

-Same coverage as Medicare Part A & B required -Advantage plans may offer extra services or expanded amounts of coverage |

Premiums, deductibles and co-pays apply. Amounts differ depending on individual plans. |

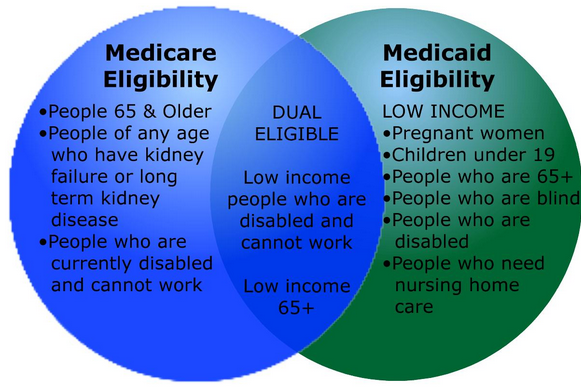

| Medicaid | -People of any age that are considered low income. Eligibility is determined by each state. -People who are blind or disabled |

All medical services are covered through programs offered by each state. Programs and rules regarding coverage vary from state to state. | Rules regarding occupational therapy services vary from state to state. Providers must participate in Medicaid and accept Medicaid assignment. | No premiums or deductibles are required. States may charge co-pays for certain services. Co-pays are capped at low levels. |

| Health Maintenance Organizations (HMO) | Anyone who is eligible for coverage, enrolls in a plan, and pays the plan premiums. | All medical services are covered. People are required to receive services from specific providers and need referrals from a primary care physician to see specialists | Limited coverage for medically acute, non-chronic, and chronic conditions. Services must be pre-certified by a case manager from the HMO. The amount and duration of services is determined by individual plans. | Low or no co-pays and deductibles if patients see providers within the HMO network. |

| Preferred Provider Organizations (PPO) | Anyone who is eligible for coverage, enrolls in a plan, and pays the plan premiums. | All medical services are covered. People pay lower costs for services received from providers who are within the PPO network, but they may see out of network providers for higher fees. | Coverage varies depending on the plan. There may be an annual limit on the number of sessions a patient may receive. Services must be certified as medically necessary by a physician. | Co-pays and deductibles are determined by individual plans. |

| Point of Service Plans (POS) | Anyone who is eligible for coverage, enrolls in a plan, and pays the plan premiums. | All medical services are covered, using a combination of HMO and PPO providers. Patients determine whether to use HMO or PPO after the initial visit. | Coverage is determined by individual plans, similar to HMO and PPO. | Co-pays and deductibles are determined by individual plans. |

| Other insurance plans | Anyone who is eligible for coverage, enrolls in a plan, and pays the plan premiums. | Coverage is determined by individual plans. Patients may have the freedom to choose their own providers. | Coverage is determined by individual plans. | Co-pays and deductibles are determined by individual plans. Costs to patients are often higher than managed care plans. |

..

Coverage for Durable Medical Equipment

Durable Medical Equipment, or DME, is equipment that is primarily used for medical purposes and can withstand repeated use. DME is not usually useful in the absence of a medical condition. Examples include wheelchairs, walkers, hospital beds, bedside commodes, patient lifts, and similar items. DME must be used in a patient’s home. Hospitals and skilled nursing facilities are not considered “home” for the purpose of coverage for DME. If a patient in a hospital or skilled nursing facility requires DME, the facility provides it. The patient may use it while he or she is at the facility, but may not take it home. Long term care facilities do qualify as “home” for DME coverage.

| Insurance Type | Coverage for DME |

| Medicare Part A | DME is provided by the facility where the patient is receiving care. Patients may use DME in that setting. Medicare Part A does not cover DME for home use. |

| Medicare Part B | DME is covered if purchased from a Medicare participating provider. A physician’s prescription is required. Medicare Part B deductible and 20% co-pay apply. DME may be rented or purchased. Medicare provides a contact number on their website for inquiries regarding whether or not an item is covered as DME. |

| Medicare Advantage Plans | DME is covered the same as Medicare Part B. Some plans may offer more coverage. |

| Medicaid | Basic DME is covered with a letter of medical justification and a Prior Approval form signed by the patient’s physician. DME must be cost effective. |

| HMO/PPO/POS/Other | DME coverage is determined by individual plans. A physician’s prescription is required. |

Outcome and Assessment Information Set- OASIS

The Outcome and Assessment Information Set (OASIS) is the patient-specific, standardized assessment used in Medicare home health care to plan care, determine reimbursement, and measure quality.

Home Health OASIS is used for three main purposes:

It serves as the basis for insurance reimbursements, as a tool that measures the quality of home health care, and as a foundation for home health care planning.

OASIS assessments are necessary for all Medicare and Medicaid home health care patients who are 18 years old and above. It is mandatory for all non-maternity and non-pediatric beneficiaries. OASIS data only needs to be gathered for patients who are currently being provided with skilled home health care. It is not required for patients who only need personal care or housekeeping services.

In terms of Medicare, home health is a covered service under the Part A Medicare benefit.

Home health eligibility criteria include:

1. Being considered “homebound.”

• You need the help of a supportive device (cane, walker, wheelchair, etc.) or another person to get out of the house OR your doctor believes your illness could get worse if you leave home.

• It takes a great deal of effort for you to leave home

• You don’t leave home often and if you do leave home, it’s for a short time and to do something you really need to do. For example, you generally can:

o Visit your doctor or get medical treatment

o Get a haircut or visit the beauty parlor

o Attend religious services

o Go to a licensed or accredited adult daycare

o Attend an important event like a wedding, family reunion, graduation, or funeral

2. Needing intermittent care from skilled professionals.

Part-time, medically necessary, skilled care (nursing, physical therapy, occupational therapy, and speech-language therapy) that is ordered by a physician.

3. Having your plan of home health care ordered and supervised by a doctor.

…

What to do if payment for occupational therapy services is denied

What to do if payment for occupational therapy services is denied

Each payer has a process for appealing denial of coverage for occupational therapy services.

The following chart summarizes the appeals process for each payer type.

| Insurance Type | Appeals Process | Deadlines | Information Links |

| Medicare Part A & B | Level 1 – redetermination by a Medicare Administrative Contractor (MAC) Level 2 – Reconsideration by a qualified independent contractor (QIC) Level 3 – Hearing before an Administrative Law Judge (ALJ) Level 4 – Review by the Medicare Appeals Council Level 5 – Judicial review in United States District Court |

Level 1 – must be filed within 120 days of receipt of the initial determination Level 2 – must be filed within 180 days of the MAC decision Level 3 – must be filed within 60 days of the QIC decision Level 4 – must be filed within 60 days of the ALJ decision Level 5 – must be filed within 60 days of the Appeals Council decision |

Medicare Part A & B Appeals Process |

| Medicare Advantage Plan | 1. Patients, their representatives, and non-contract providers may appeal the decisions of the plan.

2. Contract providers (i.e. network or preferred providers) may not appeal the decisions of the plan. 3. Level 1 reconsideration is completed by the health plan. Other levels of appeal are the same as Medicare Part A & B. |

Deadline to file each level of appeal is 60 days. | Medicare Managed Care Appeals and Grievances |

| Medicaid | Providers may appeal a decision by Medicaid to deny or reduce services. The procedures vary by state. | Procedures vary by state. | A Guide to the Medicaid Appeals Process |

| HMO/PPO/POS/Other | Procedures for appeal vary depending on the insurance plan. A provider may need permission from the person enrolled in the insurance plan to appeal a denial. | Procedures vary depending on the plan. | Sample provider appeal process, Anthem Blue Cross Blue Shield |

1. Check with the business office at the hospital or clinic to make sure that occupational therapy procedures were coded correctly. Therapists should make sure they keep current on billing codes for Medicare and Medicaid. Private insurance companies usually use the same billing codes.

2. Determine the reason for denial of payment.

3. Write an appeal letter to the third party payer. The letter should specifically address the reason for denial and provide justification for services. Documentation should be included that supports the reason for the appeal. If the insurer requires a doctor’s certification, make sure the supporting documentation includes that certification.

If a therapist is providing treatment to a patient that has a higher than normal probability of being denied payment by third party payers, the therapist should make sure that the patient (or the patient’s parent/guardian) is well aware that services may not be covered. The therapist should wait for prior approval before providing this type of service or should obtain a signed private pay agreement from the patient (or patient’s parent/guardian).

| Treatment at Higher Risk for Denial of Payment | Considerations | Example |

| Treatment for the same condition that has been provided past the third party payer’s pre-determined limitations. | A prior approval request may be submitted to the payer to obtain additional treatment time. This must be done before the treatment has been provided. | A patient’s insurance company authorized 6 sessions for treatment to a rotator cuff tear. The patient continues to demonstrate limitations in function by the 5th treatment session. The therapist must request additional sessions from the insurance company before continuing treatment past the 6th session. |

| Maintenance therapy for a chronic condition | Maintenance therapy may be approved by Medicaid if the necessity of skilled occupational therapy services to provide the therapy can be documented. | Maintenance range of motion for severe spasticity. |

| Treatment for a mental health condition | Be familiar with the third party payer’s requirements and limitations regarding mental health coverage before providing services. | A woman with schizophrenia has orders to receive occupational therapy services for independent living skills. The woman lives in an assisted living facility, so the necessity for independent living skills must be justified or payment for the services may be denied. |

| Treatment that the third party payer considers experimental | -Contact the patient’s insurance to find out if coverage is provided for the treatment before providing it.

-Treatments that are considered experimental may be changed to covered services after a period of time, or may be covered if scientific evidence of the effectiveness of the treatment can be provided. |

A woman with a diagnosis of fibromyalgia has orders for occupational therapy treatment for biofeedback to manage chronic pain. The woman’s insurance company denies payment for the service because they consider it to be experimental. |

Medicare Payment For Services Provided By OT and OTA Students

Medicare Payment For Services Provided By OT and OTA Students

Historically, OT and OTA students have participated in the delivery of occupational therapy services under the supervision of occupational therapy personnel in a variety of fieldwork sites. The Centers for Medicare & Medicaid Services (CMS) provides information about how and whether the Medicare program should provide payment for services provided by students.

For those settings that serve Medicare patients, it is important to be aware of both the new and existing Medicare payment policies. CMS has published specific criteria relating to how and when the program will pay for services when the student participates in service delivery. When developing fieldwork plans for sites that serve Medicare patients, two issues must be considered:

1. Whether Medicare payment rules specifically allow students to participate in the delivery of services to Medicare beneficiaries.

2. What type and level of supervision are required by the Medicare program.

All relevant Medicare coverage criteria must be reviewed if reimbursement is sought for services when the student participates in service delivery. In addition, many state practice acts and regulations address occupational therapy services provided by students.

Medicare Coverage of Services When a Student Participates in Service Delivery

Medicare coverage requirements state that rehabilitation services must be provided and/or supervised by a qualified clinician i.e.: qualified occupational therapist /qualified occupational therapy assistant.

Inpatient SNF Setting

Therapy students are no longer required to be in line-of-sight of the supervising therapist/assistant. Effective October 1, 2011, line-of-sight supervision is no longer required in the SNF setting The time the student spends with a patient will be billed as if it were the supervising therapist alone providing the therapy, meaning that a therapy student’s time is not separately reimbursable. The determination of whether or not a student is ready to treat patients without line-of-sight supervision is left to the discretion of the supervising therapist/assistant. Time may be coded on the MDS (Minimum Data Set) when the therapist provides skilled services and direction to a student who is participating in the provision of therapy. All state and professional practice guidelines for student supervision must be followed.

Outpatient Therapy Settings

Services provided by therapy students are not reimbursable even if provided under direct supervision of the therapist/assistant. However, when a student is in the room, the time that a qualified clinician spends with the patient is reimbursable when the medical record supports:

One of the many ways in which healthcare organizations are assessed these days is both internal and external in the form of utilization reviews. Internally, reviews are performed by designated staff members and externally, they are performed by insurance companies to determine whether they will pay for certain medical services, including occupational therapy services, for a subscriber.

For insurance companies, utilization reviews are usually completed by nurse case managers, but are sometimes completed by therapists who are employed as case managers by the insurance companies.

Several review processes fall under this type of review. The following chart summarizes each type of review and what an occupational therapist must do to ensure that a patient’s insurance company has what it needs to authorize payment for occupational therapy

| Type of Review | What the Insurance Company Does | What the Occupational Therapist Should Do |

| Precertification Review | 1. Provides a list of services that require precertification or preauthorization. Rehabilitation services, including occupational therapy, are on this list for most insurance companies.

2. Provides a precertification form and procedure that patients and providers must follow before the insurance company will authorize payment. 3. Reviews a precertification request and the supporting documentation provided with the request, including physician’s orders, initial evaluation results, and proposed treatment plan. |

1. Insure that the proper physician’s orders are in place for the services that need to be provided.

2. Conduct a thorough and appropriate initial evaluation, including objective data, and document the results. Show the evidence that supports the medical necessity of occupational therapy services based on the evaluation results. 3. Develop a client-centered treatment plan that includes functional goals and a reasonable timeline to attain those goals. |

| Concurrent Review | 1. The insurance company reviews and authorizes payment for services as they are being provided.

2. The case manager requests regular updates regarding progress during occupational therapy treatment. 3. The insurance company may authorize a limited number of sessions at a time and may require review of continued medical necessity before authorizing more sessions. 4. The insurance company may require precertification of any new treatment procedures after therapy has commenced, such as the addition of physical agent modalities to the treatment plan. |

1. Provide a clear, concise treatment plan that clearly documents the medical necessity of services.

2. Collect data on treatment goals and document progress toward goals based on that data. 3. Provide timely updates to the case manager as requested. 4. Request additional treatment sessions in a timely manner, as soon as additional treatment will be required. 5. Request precertification of any additions to the treatment plan that may require precertification. |

| Retrospective Review | 1. The insurance company reviews treatment after it has already been provided.

2. A reviewer reads through records of treatment to determine if services that were provided were medically necessary and cost effective. 3. The reviewer compares the records with records of other patients treated for the same condition. Payment for services may be approved or denied based on this review. 4. The insurance company may use the information obtained to revise its criteria for treatment of the patient’s condition. |

1. Maintain regular documentation that clearly shows the medical necessity of treatment.

2. Discharge patients from services when treatment goals are met, and patients have achieved the maximum level of independence that they need to continue with home programs or maintain function gained during treatment. 3. Be available to answer any questions regarding treatment that may be posed by the case manager. |

| Appeals Process | 1. Happens after the insurance company has denied payment for services, either by turning down precertification for services or denying payment for services already provided.

2. The insurance company provides a procedure for providers to appeal denial of payment. 3. The insurance company promises to review submitted appeals within a specific timeline and provides their review criteria for the condition treated to the provider. |

1. Complete any required forms and provide any requested documentation from treatment to the insurance company.

2. Write a letter to the insurance company according to their guidelines that clearly documents why treatment was medically necessary and why it met the insurance company’s criteria for approval. |

Utilization Review (UR) vs Utilization Management (UM)

Utilization Review

When the term Utilization Review is used, it is specifically referring to the process of reviewing patient records to assess their completion and accuracy. Utilization reviews therefore focus on health care providers reviewing patient records in order to assess quality of service.

Utilization Reviews are designed to:

• Validate the necessity of healthcare services/treatment requested

• Validate if the duration of healthcare services/treatment requested occurred within the correct time frame

Utilization Management

Utilization Management is the process of responding to the utilization review results. Through Utilization Management, plans and procedures are developed for improving the outcome of reviews. Through Utilization Management, plans and procedures can be developed to help improve the outcome of reviews. Utilization management ensures healthcare systems continuously improve and deliver appropriate levels of care.

The Continuity Assessment Record and Evaluation (CARE) Item Set

. . ……….

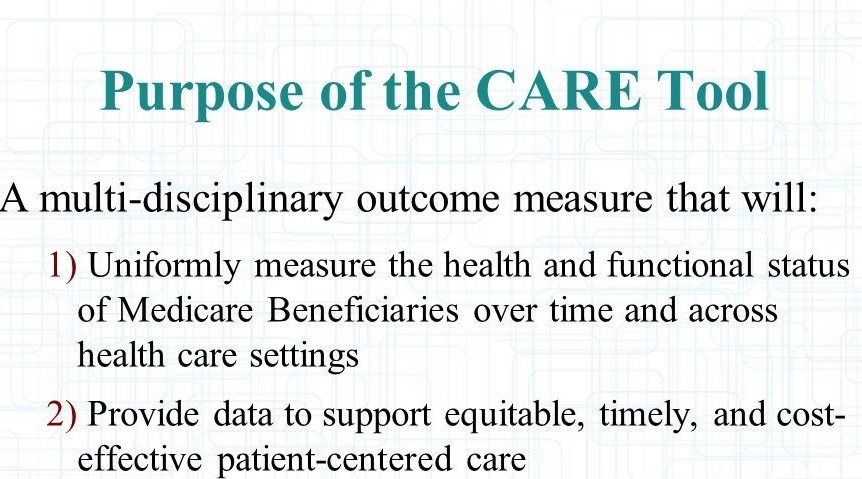

As a part of the Medicare Post-Acute Care Payment Reform Demonstration (PAC-PRD), a standardized patient assessment tool was developed for use at acute hospital discharge and at post-acute care admission and discharge. This tool was named the Continuity Assessment Record and Evaluation (CARE) Item Set. The CARE Item Set measures the health and functional status of Medicare beneficiaries at acute discharge, and measures changes in severity and other outcomes for Medicare post-acute care patients.

The CARE Item Set is designed to be a standardized assessment of patients’ medical, functional, cognitive, and social support status across acute and post-acute settings, including long-term care hospitals (LTCHs), inpatient rehabilitation facilities (IRFs), skilled nursing facilities (SNFs), and home health agencies (HHAs). The CARE Item Set targets a range of measures that document variations in a patient’s level of care needs including factors related to treatment and staffing patterns such as predictors of physician, nursing, and therapy intensity. Although the CMS or center for Medicare and Medicare replaced the FIM, some insurances may continue to use or reimburse based on the FIM.

The Self-Care CARE Items do not replace standardized assessments that occupational therapy may use for evaluation. These items are being implemented across all post-acute care (PAC) settings by Medicare (CMS).

Examples of items in the CARE tool:

| Self-care Items: | Mobility Items: |

|

|

These items are scored on a 6 point scale from independent to dependent.

6. Independent—Patient completes the activity by himself/herself with no assistance

5. Setup or cleanup assistance—Helper SETS UP or CLEANS UP; patient completes activity.

4. Supervision or touching assistance—Helper provides VERBAL CUES or TOUCHING/STEADYING and/or CONTACT GUARD ASSISTANCE as patient completes activity.

3. Partial/moderate assistance—Helper does LESS THAN HALF the effort.

2. Substantial/maximal assistance—Helper does MORE THAN HALF the effort.

1. Dependent—Helper does ALL of the effort.

Quick overview of the self-care items and a description of how to advocate for your role in the Medicare outcome measures.